Who comes to mind when you think of the economic growth drivers of our country?

It is usually the large conglomerates and the large companies.

But MSMEs contribute ~30% to our national GDP and India had 83 unicorns with a total valuation of $277.77 billion.

These sectors provide 60-70% of employment, provide 50% of worldwide GDP and generate as many as 90% of the businesses.

And providing these businesses with financial support is Kinara Capital, a fintech company driving financial inclusion of small business entrepreneurs by providing collateral-free, fast and flexible business loans. They provide MSMEs with fast and flexible business loans to help them grow their business.

Kinara Capital was founded by Hardika Shah, Founder & CEO of Kinara Capital, and she has built an organization with a clear purpose of driving financial inclusion led by a women-majority management team. Hardika holds a B.A. in Computer Science from Knox College in Illinois, USA. She earned her MBA from a joint program between Columbia Business School and UC Berkeley's Haas School of Business.

They are also one of our clients at FlexiBees, having hired a part-time and remote-working Talent Management Specialist and a Social Media Manager. So we recently caught up with Hardika Shah, CEO and founder of Kinara Capital. What ensued was an interesting conversation about the growing need for financial support for start-ups and MSMEs.

Some excerpts from our conversation:

Can you tell us a bit about what you do? What services do you provide?

Kinara Capital is a fintech driving financial inclusion of small business entrepreneurs by providing collateral-free, fast and flexible business loans. We provide MSMEs with fast and flexible business loans to help them grow their business, and our services include Asset Purchase loans, Long-Term Working Capital and Short-Term Working Capital loan in the range of Rs. 1-30 lakhs. Our myKinara app lets applicants go from decision-to-disbursement within 24 hours, while our 110 branches across 90+ cities offer doorstep customer service to MSMEs. With proprietary AI/ML-based data-driven credit decisioning, we ensure a fast process from loan application to loan disbursement and provide an automatic discount to women entrepreneurs.

Who are the founders? Can you tell us more about them?

I am the solo Founder & CEO of Kinara Capital. I have built an organization with a clear purpose of driving financial inclusion led by a women-majority management team. Kinara Capital is globally recognized for innovations in SME financing receiving IFC's 'Bank of the Year-Asia' international award, and named among 'High-Growth Companies Asia-Pacific' by the Financial Times and among 'India's Growth Champions' by the Economic Times for three consecutive years. These awards are validating and reinforce my vision to drive Kinara forward.

Before building Kinara Capital, I spent nearly two decades as a management consultant executing complex projects globally. I also served as a pro-bono mentor for social entrepreneurship programs before packing up to launch Kinara Capital.

How did it all start? How did you think of this need?

In part, I was inspired by something that I had experienced early on in life, and it has always stayed with me. My mother had entrepreneurial leanings and ran a small business when I was growing up, and I saw how difficult it was for her to build her business due to a lack of financing. Years later, as I reconnected with people from my early days on a visit back to India, I realized that my mother's struggles to set up a small business were exactly the same two decades later. Economic liberalization in India had still not addressed the massive credit gap in India for MSMEs, and many were locked out of the opportunity to grow their business. This is particularly true of women-owned businesses. There are over 60 million MSMEs in India that provide jobs to over 120 million people. Yet, most formal lending institutions do not lend to them, especially without property collateral, and I wanted to do something to change that.

This germ of an idea became a full-fledged mission when I was in business school and worked on a risk-assessment methodology and ran a pilot in India to address the financing needs of small business entrepreneurs. The success of that pilot was the genesis of Kinara; it motivated me to leave my long career in management consulting and move across the world to start Kinara Capital in 2011. About a decade later, I am proud to share that the cumulative impact of our work has led to more than Rs. 700 crores in the incremental income generated by the small business entrepreneurs and supported over 250,000 jobs in local economies in India.

When did you start seeing success? What was the turning point?

The turning point came around in 2015, four years after launching Kinara. We had hit profitability and proven that the unsecured business lending model can work in India as we focused equal parts on both scalability and social impact. The credit gap in the market limits small business entrepreneurs in India, and by seeing how we were supporting them, Kinara grew largely due to our direct outreach efforts and word of mouth. Many of our customers came back to us for their 2nd and 3rd loans as they continued to grow their business. In a short amount of time, this germ of an idea that began with me moving to Bangalore and starting Kinara by myself flourished into an organization with 1200+ people with headquarters in Bangalore and 110 branches across 90+ cities in India. We have disbursed Rs. 3000 crores to date across 75,000+ collateral-free business loans and continue to expand our support to MSMEs.

What is your differentiator?

Our differentiator is that we provide a digital model with doorstep customer service and a high-touch, high-tech approach to MSME financial inclusion. Kinara offers fast & flexible collateral-free business loans with a fully digital loan process. Customer service in vernacular goes a long way to educate and help entrepreneurs with the loan application steps. Many customers are also accessing the process themselves by downloading our myKinara app.

Share one success or achievement in the recent past

We reached the milestone of AUM Assets Under Management of Rs. 1,000 crores in collateral-free loans to small businesses last quarter. At the same time, we also celebrated Kinara’s 10th anniversary. Of course, the real success story is the impact of our work on transforming lives, livelihoods, and local economies.

What is your motto?

To create a financially inclusive world where every entrepreneur has equal access to capital.

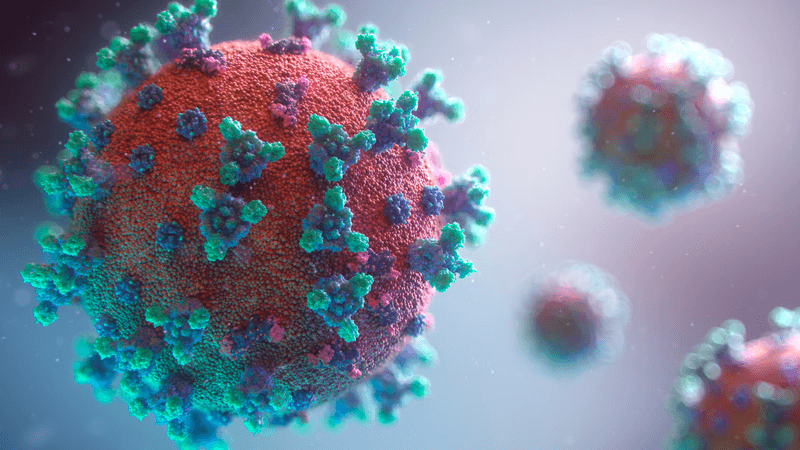

How has the pandemic affected your business?

The pandemic certainly affected MSMEs and changed our normal operations during the first lockdown. During that time, we began finding new ways to support our customers by offering the moratorium, extending the Emergency Credit Loan Guarantee Scheme (ECLGS), and introducing 400+ digital payment options at the request of our customers, and we took this time to revamp our tech. We consumerized our end-to-end digital process by launching our vernacular myKinara app that lets MSME entrepreneurs access a business loan within 24-hours. Subsequently, MSMEs have shown much resilience to the pandemic, and we are seeing a return to normalcy this year, and we hope to keep supporting MSMEs in their growth.

What are your future plans?

Our future plans are to continue doing what we do best and bring even more small business entrepreneurs into the financial inclusion fold. MSMEs are ready to make this year one of fast rebuilding and high growth, and we are prepared to support them. Specifically, we are expanding on our reach by tackling the (i) credit access gap with a user-friendly vernacular digital loan application process via the recently launched myKinara App (ii) information gap by introducing new value-add skilling services for Kinara customers, and, (iii) gender gap by supporting even more women entrepreneurs with our discounted HerVikas program.

You have hired candidates from FlexiBees, in part-time, remote working arrangements. What benefits have you received from these arrangements? How did it help your business?

The most significant benefit has been the timely availability of quality candidates. In a fast-growing business like ours, the need for personnel can arise suddenly. As the company grows, we have to bring in new talent to keep up the momentum. Recruitment and training can be a long-drawn-out process, and in some cases, it even falls through at the last minute. Through FlexiBees, we have been able to onboard experienced candidates in short order, some of whom have even become full-time employees.

And what has been your experience with FlexiBees?

FlexiBees understand the needs of a fast-growing company, and they also align very well with the nuances of a women-led organization focused on equal opportunity. Their objective ties in well with our mission of bringing more women into the workforce and helping them reach their true potential. As a whole, our experience of working with FlexiBees has been a positive one.